Maximize Your Advantages with VA Home Loans: Lower Passion Rates and Flexible Terms

Maximize Your Advantages with VA Home Loans: Lower Passion Rates and Flexible Terms

Blog Article

The Important Guide to Home Loans: Unlocking the Advantages of Flexible Funding Options for Your Dream Home

Navigating the complexities of mortgage can usually feel challenging, yet comprehending flexible financing alternatives is necessary for potential property owners. With a selection of lending types offered, including variable-rate mortgages and government-backed options, debtors can tailor their funding to straighten with their specific economic situations. These versatile choices not just provide reduced initial payments however might also offer unique advantages that boost availability to homeownership. As you think about the myriad of options, one must ask: what elements should be prioritized to guarantee the ideal fit for your financial future?

Recognizing Home Loans

Understanding home mortgage is essential for potential home owners, as they stand for a considerable financial dedication that can affect one's monetary health and wellness for years ahead. A mortgage, or mortgage, is a kind of financial debt that permits people to borrow money to purchase a residential or commercial property, with the residential property itself acting as security. The lending institution supplies the funds, and the debtor consents to repay the lending quantity, plus passion, over a specified duration.

Secret elements of home finances consist of the principal quantity, interest price, lending term, and monthly repayments. The principal is the initial funding quantity, while the rates of interest identifies the expense of borrowing. Financing terms usually vary from 15 to 30 years, affecting both month-to-month payments and overall rate of interest paid.

Sorts Of Flexible Financing

Versatile financing options play an important function in suiting the varied demands of property buyers, allowing them to tailor their mortgage services to fit their financial situations. Among the most prevalent kinds of flexible funding is the variable-rate mortgage (ARM), which uses a first fixed-rate duration complied with by variable prices that change based on market conditions. This can give reduced preliminary repayments, attracting those that anticipate revenue development or strategy to transfer before prices change.

An additional alternative is the interest-only home loan, permitting customers to pay only the passion for a specified period. This can lead to reduced regular monthly payments initially, making homeownership extra accessible, although it might result in larger settlements later on.

Additionally, there are additionally hybrid car loans, which combine functions of taken care of and adjustable-rate home loans, supplying stability for an established term followed by changes.

Last but not least, government-backed loans, such as FHA and VA car loans, use versatile terms and lower down payment demands, dealing with novice purchasers and professionals. Each of these options provides distinct benefits, enabling homebuyers to choose a financing option that lines up with their lasting individual situations and financial goals.

Benefits of Adjustable-Rate Mortgages

How can adjustable-rate home loans (ARMs) profit property buyers seeking economical financing options? ARMs supply the capacity for lower first rate of interest contrasted to fixed-rate home loans, making them an appealing option for customers looking to decrease their month-to-month repayments in the early years of homeownership. This preliminary duration of reduced prices can substantially boost cost, allowing property buyers to spend the savings in various other top priorities, such as home renovations or financial savings.

Additionally, ARMs commonly feature a cap framework that limits just how much the rates of interest can boost during change durations, giving a degree of predictability and protection against extreme fluctuations in the marketplace. This attribute can be especially helpful in a climbing rates of interest environment.

Moreover, ARMs are ideal for buyers that intend to refinance or offer before the car loan adjusts, enabling them to profit from the lower rates without direct exposure to possible price increases. Therefore, ARMs can act as a strategic monetary device for those that fit with a degree of danger and are looking to maximize their acquiring power in the present real estate market. Generally, ARMs can be an engaging alternative for savvy homebuyers seeking flexible funding remedies.

Government-Backed Loan Alternatives

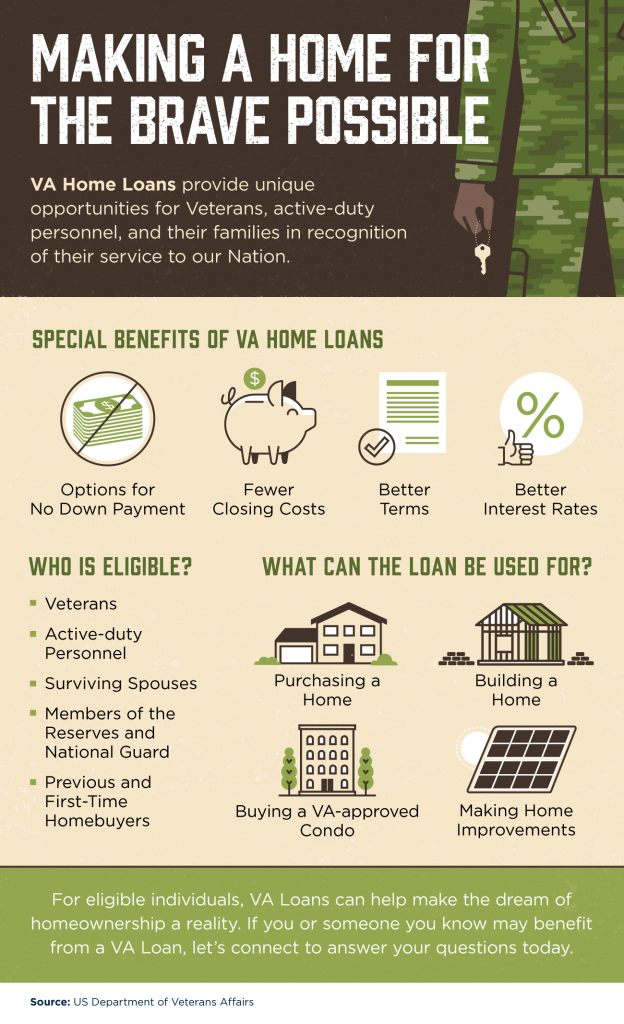

FHA loans, guaranteed by the Federal Real Estate Management, are excellent for new homebuyers and those with lower credit history. They usually require a reduced down repayment, making them a preferred choice for those who may battle to save a considerable quantity for a traditional finance.

VA financings, available to professionals and active-duty military workers, provide favorable terms, consisting of no down payment and no private home loan insurance (PMI) This makes them an attractive alternative for eligible debtors seeking to buy a home without the problem of added costs.

/mortgagemarvel/VA_Mortgage_Home_Loans_Florida_Tampa_Clearwater_Macdill_AFB_Wesley_Chapel_Riverview_South_Tampa_Hyde_Park__Unconventional_lending_Derek_Bissen-s7a34.jpg)

Tips for Selecting the Right Funding

When examining loan choices, borrowers frequently gain from extensively assessing their financial situation and long-term goals. Begin by establishing your spending plan, which includes not only the home acquisition rate however additionally extra expenses such as building taxes, insurance coverage, and maintenance (VA Home Loans). This thorough understanding will guide you in picking a lending that fits your economic landscape

Following, think about the sorts of fundings readily available. Fixed-rate home loans supply stability in month-to-month settlements, while adjustable-rate home mortgages might offer lower initial prices but can change over time. Examine your danger tolerance and how much time you plan to stay in the home, as these variables will influence your finance choice.

Furthermore, inspect rates of interest and costs connected with each car loan. A reduced interest price can considerably reduce the total price gradually, however bear in mind shutting expenses and other fees that could offset these cost savings.

Final Thought

In final thought, navigating the landscape of mortgage exposes numerous versatile funding options that deal with varied borrower demands. Understanding the complexities of different funding kinds, consisting of government-backed lendings and adjustable-rate home loans, allows informed decision-making. The benefits provided by these funding techniques, such as lower first settlements and customized advantages, eventually enhance homeownership availability. An extensive assessment of readily available alternatives makes certain that prospective house owners can secure one of the most suitable funding option for their special monetary circumstances.

Navigating the intricacies of home finances can frequently feel overwhelming, yet comprehending adaptable funding look at these guys alternatives is crucial for potential home important site owners. A home finance, or home loan, is a type of debt that enables individuals to obtain money to acquire a residential or commercial property, with the property itself serving as security.Key elements of home car loans consist of the primary amount, passion rate, loan term, and month-to-month settlements.In conclusion, navigating the landscape of home fundings reveals numerous versatile funding choices that provide to varied borrower demands. Comprehending the ins and outs of numerous loan types, consisting of adjustable-rate home loans and government-backed financings, enables educated decision-making.

Report this page